As we end the 2018 tax preparation season, it is important that we review some of the components of the new tax laws that were enacted at the end of 2017.

One of the more significant items is the elimination of the potential for deductibility for investment advisory fees. This would also include fees paid to your tax preparer as well as other miscellaneous itemized deductions. A significant amount of our planning involved trying to position fees so that they were potentially deductible. If you have a situation where you have a taxable account along with an IRA account, we often times would charge the fee for the IRA account to the taxable account in addition to the taxable account’s own fee, therefore making both fees potentially tax deductible. Going forward an IRA should pay its own fee; it is not as beneficial as a current deduction like you could have potentially achieved under the old law, but at least doing it that way gives you a future tax deduction.

The $10,000 limit on state and local taxes also has a number of implications. Many people who formerly itemized will no longer be able to do so because the standard deduction for married couples has gone up to $24,000. If you’re limited to $10,000 in deductible state taxes you need to come up with $14,000 in other itemized deductions such as charitable contributions or perhaps medical expenses in order to be able to itemize. We expect the number of taxpayers who are going to be itemizing will be down significantly; many may find they are able to prepare their own tax returns going forward.

The changes to the Alternative Minimum Tax (AMT) are also significant. The AMT is a parallel tax structure with its own set of rules. It disallows certain tax deductions when calculating a minimum amount of tax that you need to pay – such as state and local tax deductions and dependent exemptions. Many investors found themselves paying AMT because of their state tax deductions. Now with that limited to $10,000, it will affect a much smaller number of taxpayers. Moreover, the AMT exemption amounts increase to $70,300 for single filers and $109,400 for joint filers and the income phase out for those taxpayers increases to $500,000 and $1 million, respectively. Not only did they increase the exemption, but they increased the income at which the exemption would phase out, knocking out another large swath of taxpayers who will no longer be subject to the AMT.

The change in the corporate tax rate has been widely reported. This lower rate should result in a financial boom for corporations. It’s interesting to note that the U.S. corporate tax rate was among the highest in the developed world. The average corporate tax rate in the developed world is 22 percent and now the U.S. is at 21 percent. Being closer to the average tax rate should bode well for U.S.-based companies, allowing them to keep their operations and profits here in the U.S.

There is also an important change for business owners who use a pass-through tax entity to avoid double taxation on profits. Individuals who have an LLC or partnership may now take a 20 percent deduction on their pass-through business income subject to phase outs for those earning above $157,500 (single) and $315,000 (married, filing jointly). The 20 percent deduction is intended to put the tax load on pass-through entity income par with the reduced tax load for a C-corporation.

While things are different, the good news is that almost every taxpayer should see some reduction in their taxes. The additional spending that should generate in the economy should be very good for us.

Thomas W. Batterman is Principal and Fiduciary Advisor at Financial Fiduciaries, LLC. He can be reached at tbatterman@yourfiduciaries.com or 715-848-8110, ext. 302.

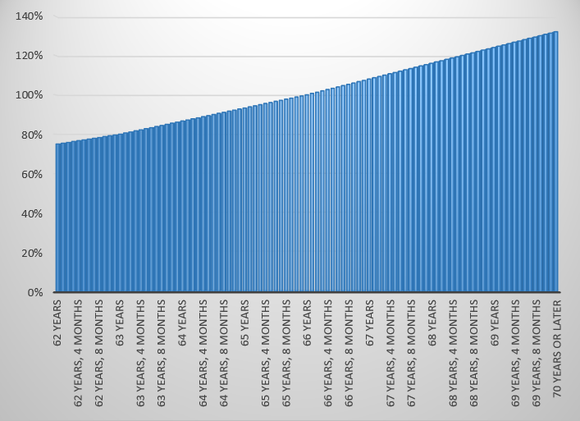

THE SOCIAL SECURITY RETIREMENT BENEFIT SCHEDULE FOR PEOPLE BORN BETWEEN 1943 AND 1954. CHART BY AUTHOR. DATA SOURCE: SOCIAL SECURITY ADMINISTRATION.

THE SOCIAL SECURITY RETIREMENT BENEFIT SCHEDULE FOR PEOPLE BORN BETWEEN 1943 AND 1954. CHART BY AUTHOR. DATA SOURCE: SOCIAL SECURITY ADMINISTRATION.